Today during Meta’s Q1 2022 earnings call CEO Mark Zuckerberg told shareholders that they should buckle up for the long haul because the company’s steep investments in XR and metaverse technologies aren’t expected to flourish until the next decade.

Today Meta gave its shareholders a quarterly update, in which the company overviewed its latest earnings and expenses.

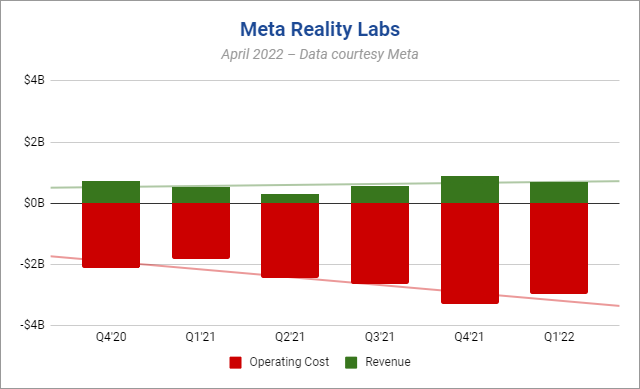

For Reality Labs, the company’s XR and metaverse division, revenue was up 30% year-over-year, from $534 million in Q1 2021 to $695 million in Q1 2022.

However, costs associated with running the Reality Labs division rose even more, up by 62% year-over-year, from $1.83 billion in Q1 2021 to $2.96 billion in Q2 2022.

This growth in costs wasn’t unexpected. Meta told investors last year they should expect the company’s XR investments in 2021 to total $10 billion… and to grow even more from there.

Meta CEO Mark Zuckerberg has been asking for investor patience in his vision for XR and metaverse technologies for years. Back in 2017 he was already prepping investors for a long haul, saying that in order to reach mainstream tracition, XR would need a 10 year trajectory from the year the company acquired Oculus—a timeline that pushed out to 2024.

But in Zuckerberg’s eyes that timeline may have slipped considerably.

Today during Meta’s Q1 2022 earnings call, during a lengthy, unscripted response to a shareholder question, Zuckerberg said that he didn’t expect the company’s metaverse and XR investments to really flourish until the 2030s.

So we have multiple teams in parallel that we’ve sort of now spun up [to build XR and metaverse tech]. This goes for VR as well as augmented reality and the other work that we’re doing and is sort of driven by the success that we feel like we’re seeing in the markets and the technology is starting to be ready to really ramp up.

So those [operating losses for Reality Labs], we’re experiencing today. I mean, having those teams operating is something that you see weigh on the results and is one of the reasons why I think the growth rates and expenses have been so high, and I think we’ll continue investing more over some period. But at some point, we will have all those product teams fully staffed for a few versions into the future and then the growth rates there will come down.

But it’s not going to be until those products really hit the market and scale in a meaningful way and this market ends up being big that this will be a big revenue or profit contributor to the business. So that’s why I’ve given the color on past calls that I expect [substantial revenue from Reality Labs] to be later this decade, right?

Maybe primarily, this is laying the groundwork for what I expect to be a very exciting 2030s when this is like—when this is sort of more established as the primary computing platform at that point. I think that there will be results along the way for that, too. But I do think that this is going to be a longer cycle.

To be fair, the company’s initial ’10 year trajectory’ included only a vague idea of the metaverse—something that, despite still being somewhat nebulous—has come into clearer focus in the eight years since Meta acquired Oculus and set out to build ‘the next computing platform’.

Meta arguably didn’t take its first stab at trying to figure out what the metaverse might look like until 2016 when it began seriously experimenting with social VR in what would ultimately become Facebook Spaces, the company’s first social VR app which launched in 2017.

Even so, progress has been slow. Facebook Spaces was shut down in 2019, to be superseded by Horizon. But Horizon—which was first announced in 2019—didn’t launch until the far end 2021… and it’s still only available to a limited audience.

For shareholders seeing Meta spend $2–$3 billion on Reality Labs per quarter… it makes sense why the company is being regularly questioned about its steep spending. Zuckerberg’s suggestion that the investments won’t really flourish until the 2030s surely isn’t going to help matters.

To that end, Zuckerberg said during the earnings call that the company’s plan is to use revenue from its non-XR businesses (Facebook, Instagram, and the like) to fund its aggressive and forward-looking spending. For investors to stick around for the long haul, Zuckerberg is going to need to continue to emphatically sell his belief that XR is the next computing platform and explain why shareholders should stick around for the ride.

The post Zuckerberg Warns Shareholders: Metaverse Investments May Not Flourish Until 2030s appeared first on Road to VR.

from Road to VR https://ift.tt/MUQGdh9

via IFTTT

No comments:

Post a Comment